Nanny tax calculator

Nanny Tax Calculator Cost Calculator for Nanny Employers. Payroll So Easy You Can Set It Up Run It Yourself.

How To Calculate Your Nanny Taxes

Computation of Nanny Tax.

. Your household income location filing status and number of personal. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will. Then print the pay stub right from the calculator.

Check estimated costs and info associated with different full-time child care options in your area. Talk to a Specialist. These calculations assume sole employment and that a standard tax code is being used for the Tax Year 2018-19.

Student loan repayments can also. Ad Easy To Run Payroll Get Set Up Running in Minutes. When calculating taxes youll always pay a percentage of your nannys gross wages.

If you choose not to enter a tax code the default 1250L will be applied. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Understanding gross v.

Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. Taxes Paid Filed - 100 Guarantee. This calculator assumes that you pay the nanny for the full year.

If the nanny has other employment the results shown will not apply. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. Payroll So Easy You Can Set It Up Run It Yourself.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Were here to help. Our experts are available to answer your questions about paying household employees.

Enter the number of children their ages and your location. Delaware DE Transfer Tax. 1250L is the tax code currently used for most people who have one job or pension.

These rates are the default rates for employers in. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax. Taxes Paid Filed - 100 Guarantee.

Taxes Paid Filed - 100 Guarantee. Ad Easy To Run Payroll Get Set Up Running in Minutes. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home.

Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. The Nanny Tax Company has. Get your FREE step-by-step guide to managing Nanny Tax Payroll.

This is their pay before any withholdings or. Please tick this box if you would like to receive advice and relevant news on employing and working with nannies and. As for Social Security and Medicare tax.

Virginia will provide a penalty waiver to those nanny employers affected by Hurricane Sandy - extends filing deadline. Its simple and free. The State of Delaware transfer tax rate is 250.

Taxes Paid Filed - 100 Guarantee.

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

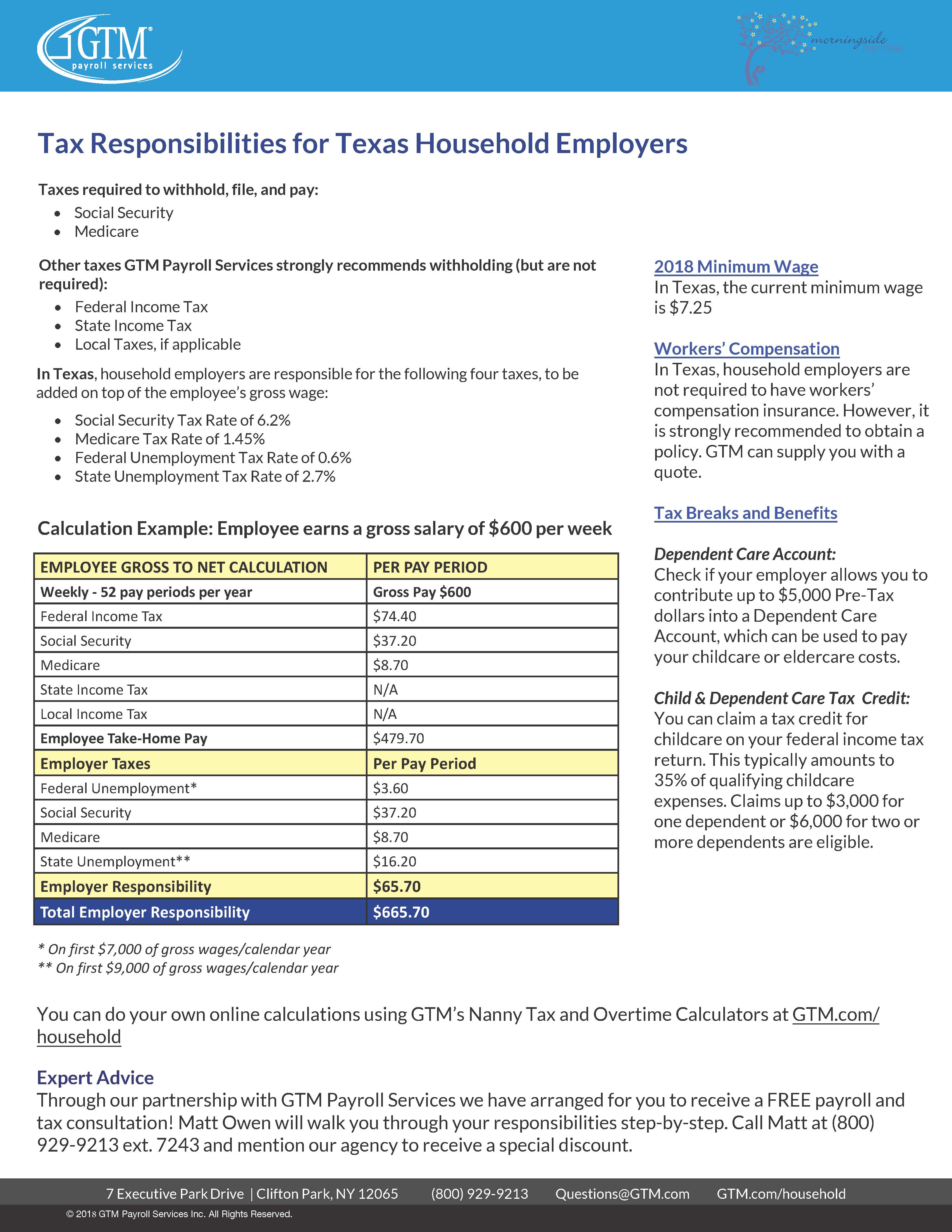

2018 Nanny Tax Responsibilities

Nanny Tax Calculator Gtm Payroll Services Inc

Try Our Nanny Tax Calculator

Nanny Tax Payroll Calculator Gtm Payroll Services

Paycheck Nanny Calculate Tax Apps On Google Play

Nanny Tax Calculator Nanny Lane

How To Reduce Your Nanny Taxes Aunt Ann S In House Staffing

Nanny Tax Payroll Calculator Gtm Payroll Services

How To Create A W 2 For Your Nanny Nanny Tax Tools

The Ultimate Nanny Tax Guide Nannypay

How To Catch Up On Year End Taxes For Household Employees Sittercity

Nanny Tax Payroll Calculator Gtm Payroll Services

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Household Employment Blog Nanny Tax Information Household Paycheck Calculator

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block